- +20 Years proven track record.

- +96% Occupancy rates across +500 units.

- Cayman Island Monetary Authority, Monetary Authority of Singapore accredited, ISO 27001 certified.

Your Investment

Minimum $100,000 USD, further investments $50,000.

Initial investment

$500,000

$100,000

$1,000,000

Investment period

5 years

1 years

10 years

Total yield

$100,000

Based on past performance, which is not an indicator of future performance.

MoHalogy

Latest videos

Frequently Asked Questions

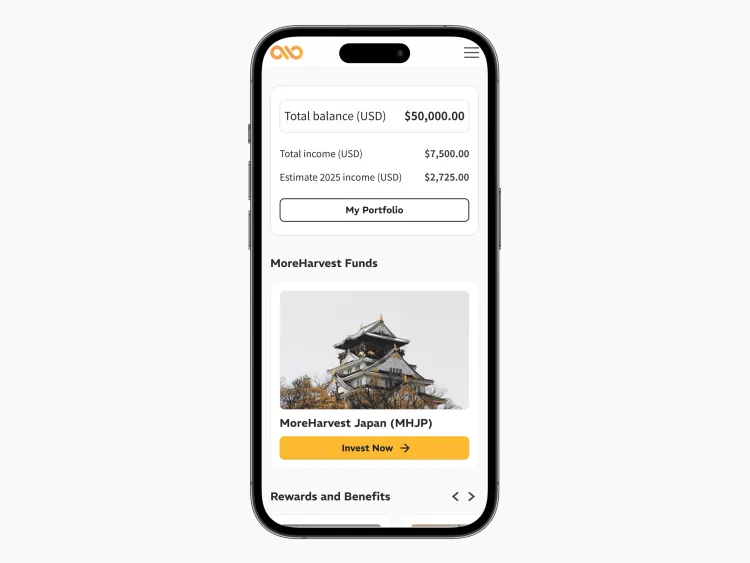

What am I investing in?

Our Fund, MoreHarvest Japan [MHJP], contains 17 properties or over 300 rentable apartments. Each property has been built and designed for that local market to get the most out of the rental income and overall desirability. With 1 share, you can own a piece of these properties.

When do I get paid?

You can set your own minimum payment threshold. Once your earnings exceed this amount, you will receive payment either when your shares mature after one year or on the next scheduled dividend payout date.

How does MoreHarvest compare to other options?

Owning a rental property can be rewarding but challenging. Selecting the right location and timing is key for profitability. Protecting the property from environmental risks, finding reliable vendors for maintenance and legal services, and managing tenants while ensuring timely rent and upkeep require careful effort.

How does MoreHarvest maintain high occupancy?

Partnering with local experts provides valuable on-the-ground insights, enabling us to identify prime locations for buying or building and understand demographic trends. We prioritize our tenants, designing properties with their needs in mind and maintaining high standards. Always seeking new opportunities, our flexibility and scalability allow us to expand into other cities and regions.

What is a portfolio/fund of properties?

17 properties or over 300 rentable apartments in Tokyo, Yokohama, Kanagawa, Sapporo and Osaka.

Got anymore questions?

12F-5, No.189, Section 2, Keelung Rd. Xinyi District, Taipei City, Taiwan 110.

Designed in Taipei, Taiwan